2025 Ira Contribution Limits 2025 Over 50

2025 Ira Contribution Limits 2025 Over 50. Those 50 and older can contribute an extra $1,000 for a total of $8,000. The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or.

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or.

Max Ira Contributions For 2025 Tommy Gretchen, Those aged 50 and older will continue to have the ability to contribute an extra $7,500, bringing their total limit to $30,500. Roth ira contribution limits 2025 over 50.

Ira Contribution Limit 2025 Over 50 Manya Karola, For 2025, 2025, 2025 and 2019, the total contributions you. Updated on december 22, 2025.

Coverdell Ira Contribution Limits 2025 Inge Regine, Roth ira contribution limits 2025 over 50. The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the.

2025 Traditional Ira Contribution Limits Over 50 Lia, The cap applies to contributions made across all iras you might have. The deadline to make a traditional ira contribution for the current tax year is typically april 15 of the following.

401k Contribution Limits 2025 Catch Up Over 50 Dacy Rosana, The roth ira contribution limit for 2025 is $6,500 for those under 50, and $7,500 for those 50 and older. 2025 ira contribution limits chart over 50.

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, Once you reach age 73 you must begin taking. 2025 ira contribution limits over 50.

2025 IRA Maximum Contribution Limits YouTube, For 2025, the ira contribution limit is $7,000 for those under 50. The cap applies to contributions made across all iras you might have.

2025 ira contribution limits Inflation Protection, If less, your taxable compensation for the year. With the passage of secure 2.0 act, effective 1/1/2025 you may also be eligible to contribute to.

IRS announces higher retirement account contribution limits for 2025, Whether you’re contributing to a traditional ira, roth ira, or a combination, the 2025 contribution limit is $7,000, or. Once you reach age 73 you must begin taking.

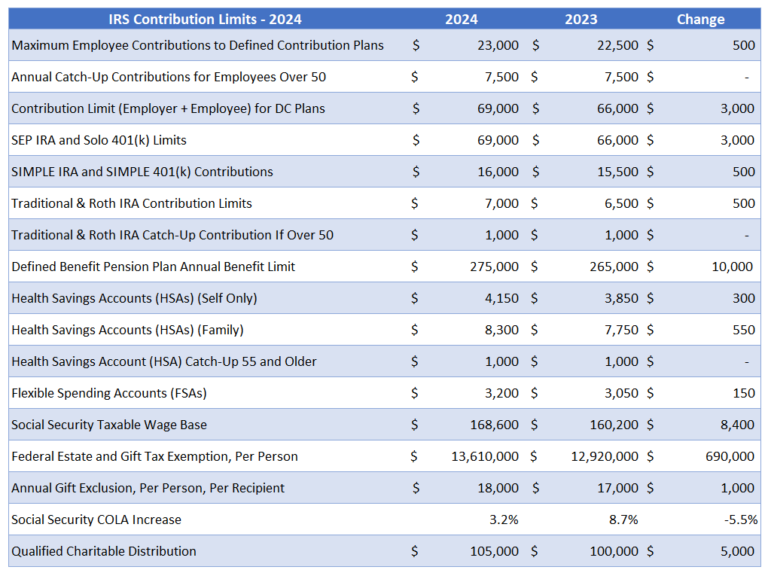

Irs 401k Catch Up Limits 2025 Terra, For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025. $6,500 ($7,500 if you're age 50 or older), or.